नमस्कार दोस्तों ,

आज हमलोग समझेंगे Reliance Nippon Life की Guaranteed Money Back Plan वो भी कुछ Special Features के साथ।

Special Features

- Guaranteed Money Back during last 5 Policy years

- Guaranteed L.A up to 40% of S.A

- Guaranteed Maturity up to 20% of S.A

- Inbuilt WOP Benefits

- Inbuilt Accidental Benefits

- On Death Guaranteed S.A

Special Death Benefits

- Inbuilt Waiver of Premium

- On death of the Life Assured, all future premiums under the plan will be waived.

- Inbuilt Accidental Death Benefits

- On death of the life Assured, an accident Nominee will receive another Benefits equal to Sum Assured.

- Continuation of Guaranteed Benefits

- On death of the Life Assured during the Policy Term, provided the Policy is in-force the nominee will receive the Money Back Benefits and Maturity Benefits at specified times.

GMB Plan Eligibility

- Entry Age – 18 to 58 years

- Maturity Age – 33 to 75 years

- Policy Term – 15,20

- PPT – 5,7,10,15 & Regular

- Premium paying mode- yearly, Half-yearly, Quarterly, Monthly

- S.A – min-50,000/-, Max- No limit

Modal Rebate

You have an option to pay the Regular Premium either Yearly, Half-yearly, Quarterly or Monthly modes. Quarterly and monthly modes are allowed only if the premiums are paid electronically.

Rebate on premiums are allowed as mentioned in the table below:

High Sum Assured Rebate

A High Sum Assured Rebate is offered under the plan as mentioned in the table below:

Guaranteed Money Back Benefits

Guaranteed Money Back Benefits as a percentage of Sum Assured will be paid during the last 5 Policy Years as per the table given below, irrespective of survival of the Life Assured.

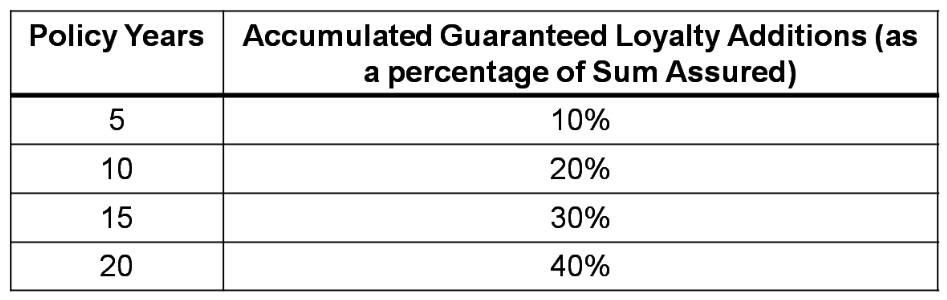

Guaranteed Loyalty Additions

Guaranteed Loyalty Additions of 2% of Sum Assured will accrue at the end of every Policy Year and will be paid on maturity, provided the Policy is not lapsed or surrendered.

For example :-

Guaranteed Maturity Addition

- Vijay, aged 30 years, opts for Reliance Nippon Life's Guaranteed Money Back Plan and,

- Selects a Policy Term of 20 years, premium payment term of 7 years and Sum Assured amount of 2,30,840

- Pays an annual premium of `30,000 p.a. (exclusive of taxes), assuming that he is in good health

- Receives Guaranteed Money Back during the last 5 Policy Years + Guaranteed Loyalty Additions + Guaranteed Maturity Addition at maturity

- In the unfortunate event of his demise, his nominee receives the Death Benefit, future premiums are waived and the Guaranteed Benefits continue

If Vijay, i.e., the Life Assured, survives till maturity

Case Study – 2

0 Comments